Read more...

AU TODAY

Stay Informed With Our Latest News

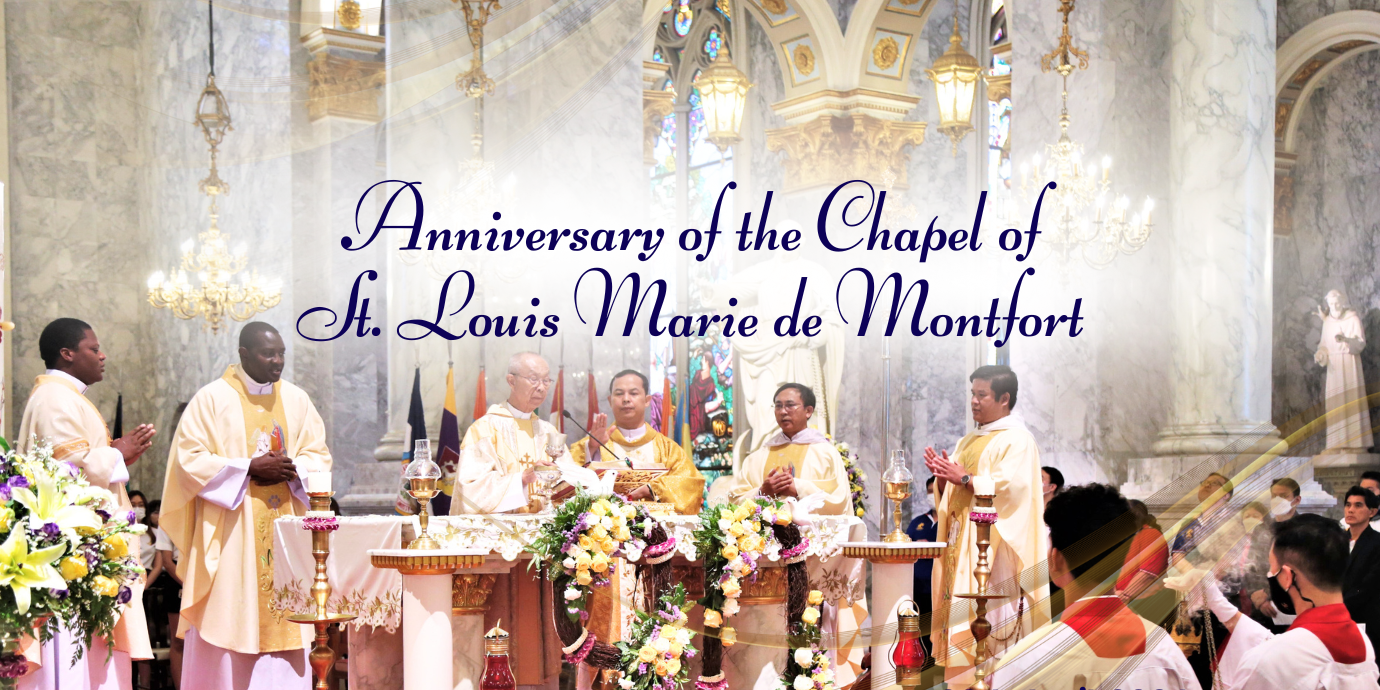

AU EVENTS

Past, Present & Future

Apr. 17- May 17, 2024

Apr. 26, 2024

Apr. 29, 2024

ANNOUNCEMENT

FACTS AND FIGURES

Academic Year 2023

97

COUNTRIES

60

ACADEMIC PROGRAMS

12

SCHOOLS

112,152

ALUMNI

ACADEMICS

World Class, Interactive, Customized Programs

Undergraduate

Programs

We Offer over 25 Internationally and Nationally Accredited Programs from

10 Schools

Graduate

Programs

We Offer over 34 Internationally and Nationally Accredited Programs from

2 Schools

Joint Programs

& Double Degree

Joint Programs & Double Degree with 6 Universities in UK, Germany, France,

Australia, USA, etc.

ABOUT AU

Leadership, Awards & Facilities